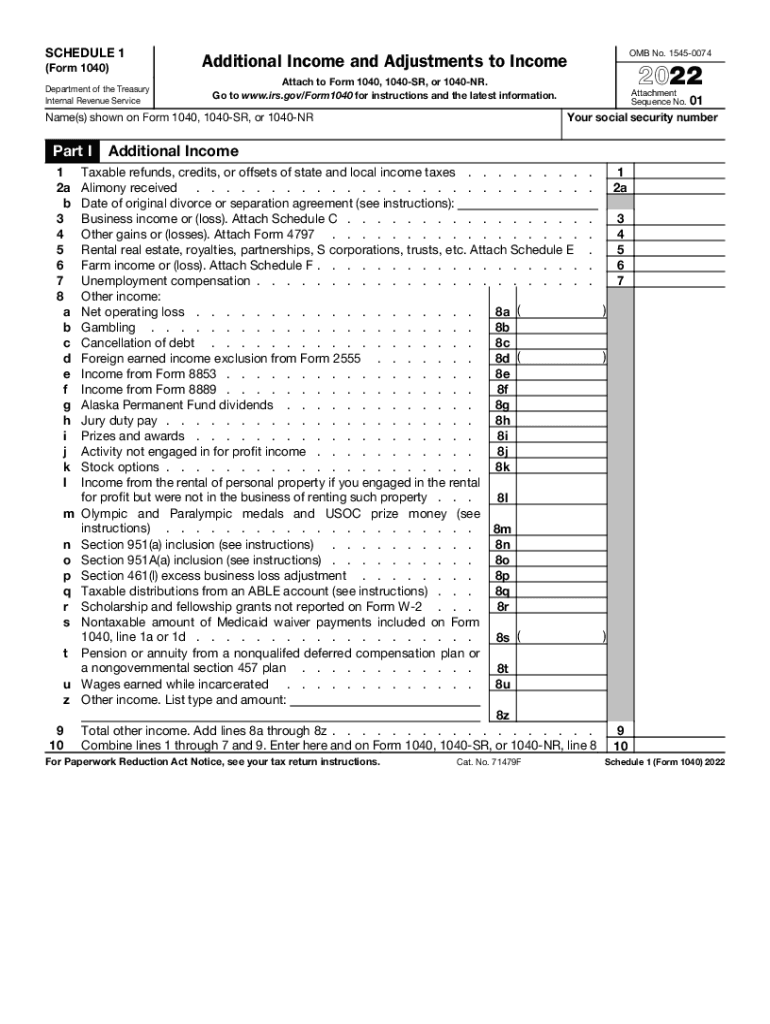

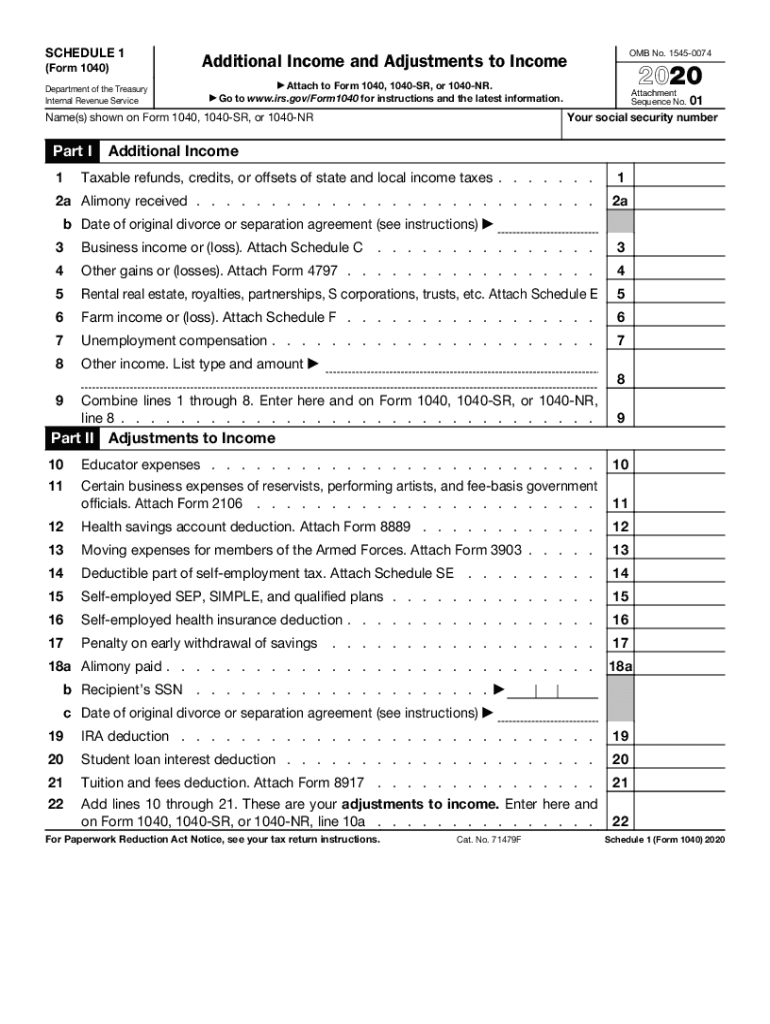

2024 Schedule 1 Form 1040. Enter the amount you earned from tax credits, tax refunds or offsets for. Schedule 1 is necessary if you have had any additional income or adjustments to your income.

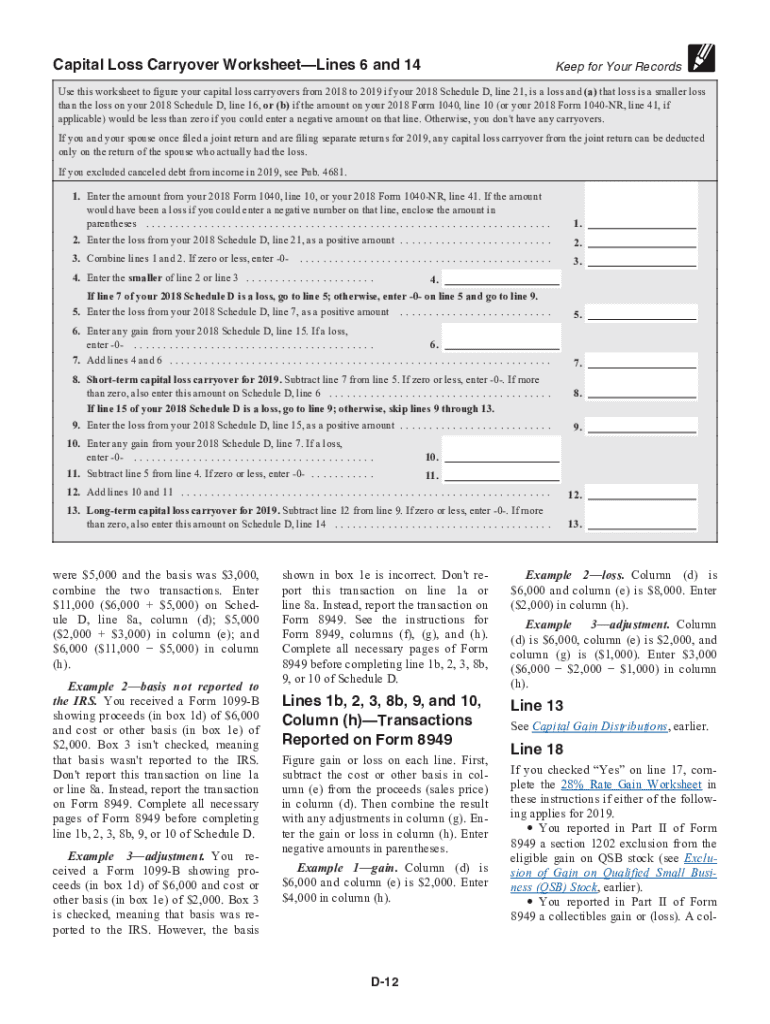

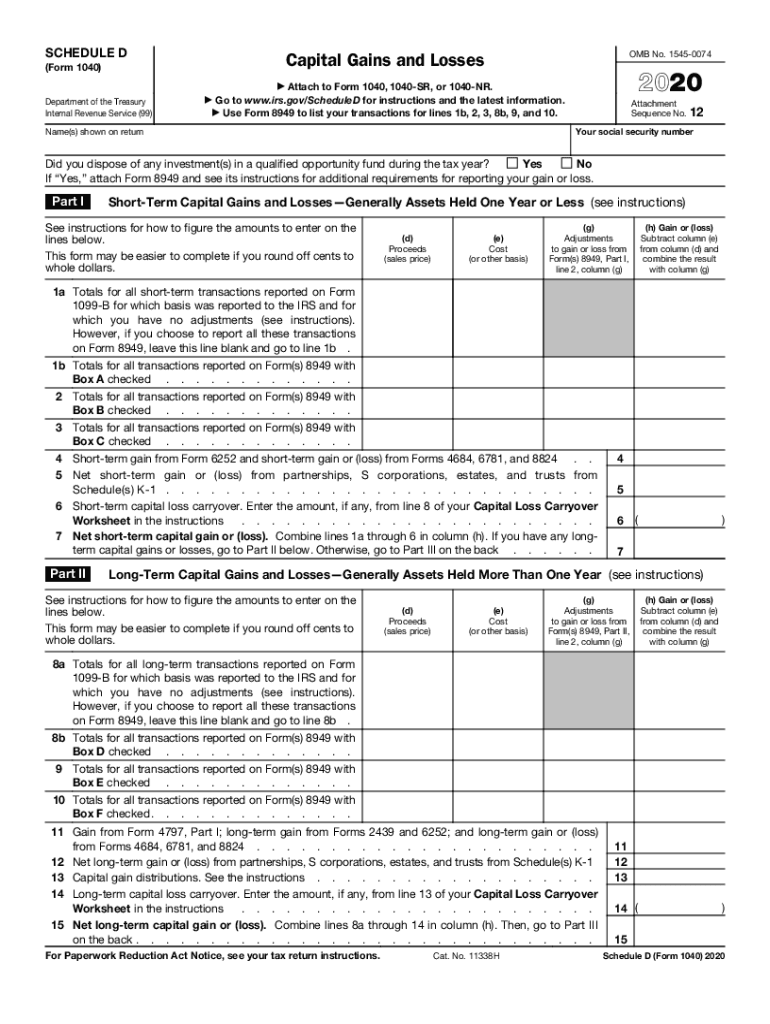

The latest versions of irs forms, instructions, and publications. Understanding how to report capital gains and losses on your tax forms is crucial for anyone dealing with investments or asset sales.

Understanding How To Report Capital Gains And Losses On Your Tax Forms Is Crucial For Anyone Dealing With Investments Or Asset Sales.

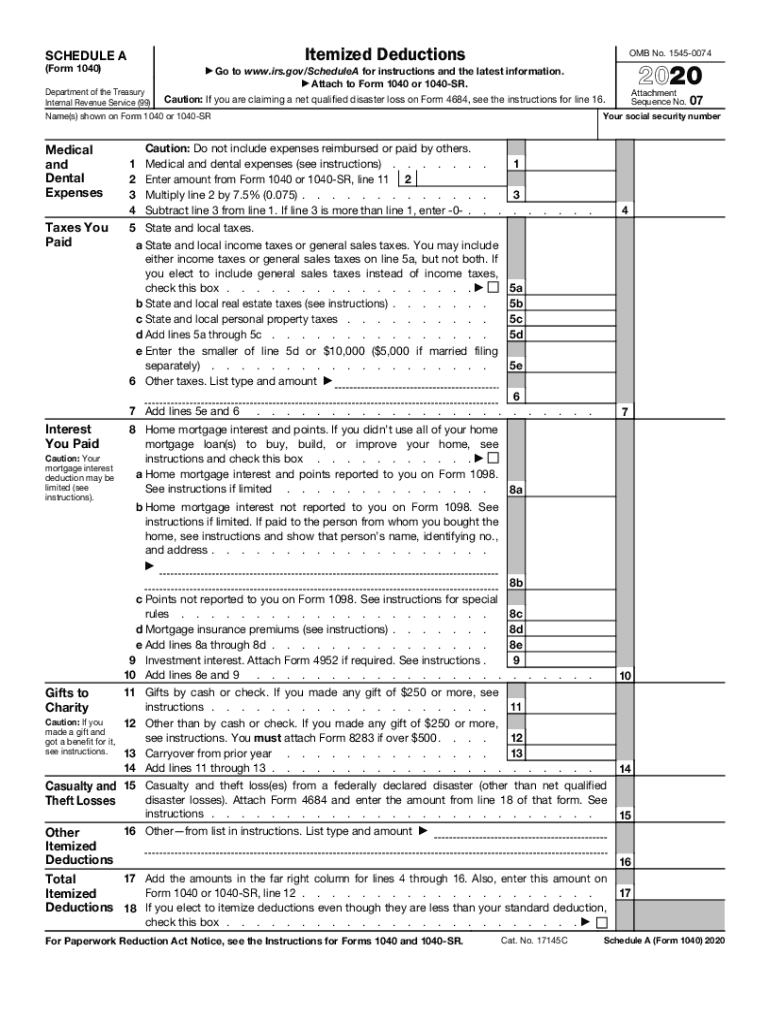

How to get a form 1040, schedule a, schedule d or other popular irs forms and tax publications for 2024, plus learn what the most common irs forms are for.

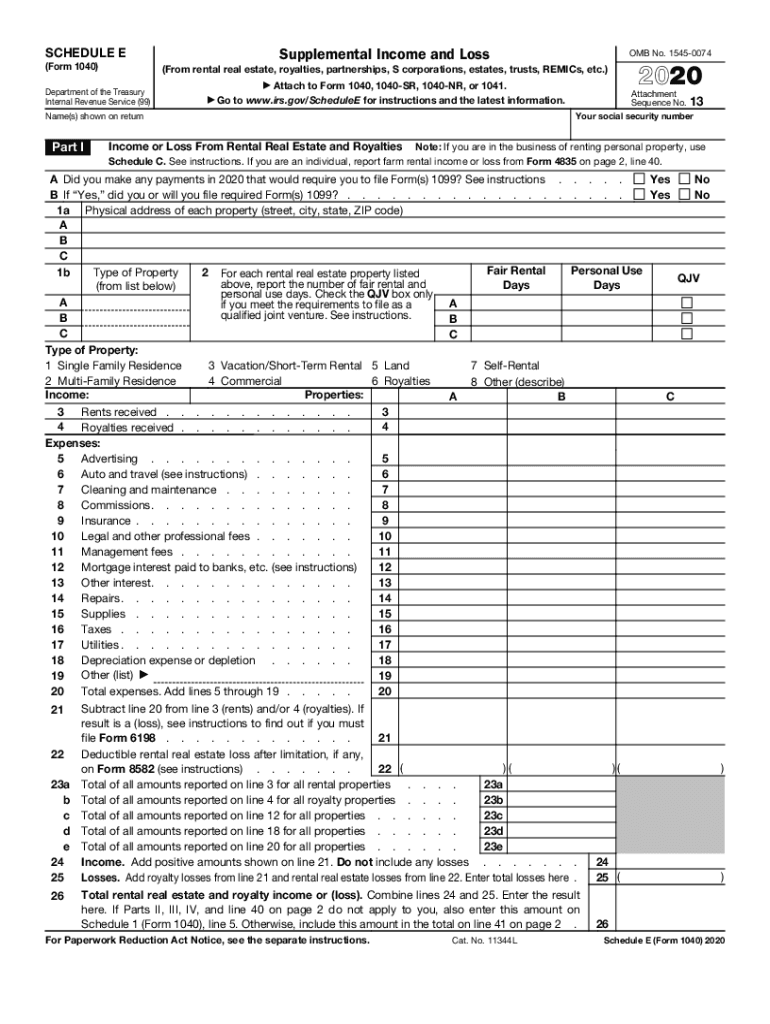

This Would Include Business Income, Rental Income, And Student Loan.

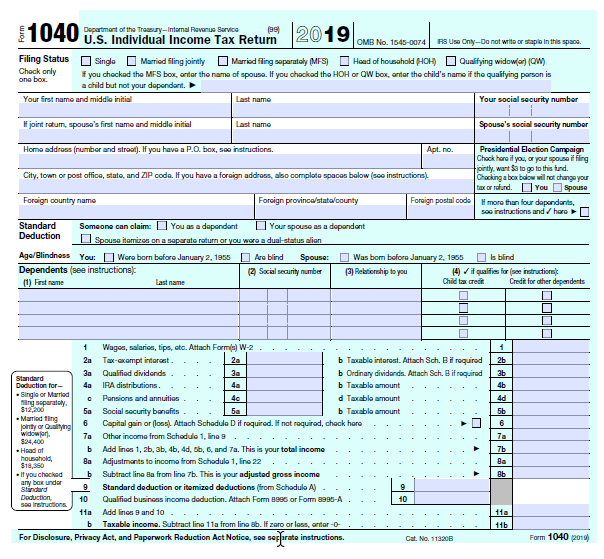

The internal revenue service will soon release a comprehensive set of 1040 tax forms, schedules, and instructions for the tax year 2024.

Schedule 1 Has The Following Additional Income And Adjustments To Income.

Images References :

Source: www.signnow.com

Source: www.signnow.com

Schedule 1 20222024 Form Fill Out and Sign Printable PDF Template, Complete form 1040, attach schedule 1, and add the amount to line 18 under adjustments to income. This article focuses on schedule 1 of irs form 1040, a crucial component for those looking to optimize their tax returns.

Source: printableformsfree.com

Source: printableformsfree.com

2023 Irs Tax Forms 1040 Printable Forms Free Online, Enter the amount you earned from tax credits, tax refunds or offsets for. Schedule 1 has the following additional income and adjustments to income.

.pdf/page1-1200px-Form_1040_(2021).pdf.jpg) Source: en.wikipedia.org

Source: en.wikipedia.org

Form 1040 Wikipedia, Complete form 1040, attach schedule 1, and add the amount to line 18 under adjustments to income. Here's what you should do, line by line, to complete schedule 1 for 2024.

Source: www.signnow.com

Source: www.signnow.com

Irs 1040 Schedule Instructions 20202024 Form Fill Out and Sign, Schedule 1, also referred to as the additional income and adjustments to income form, is an essential component of your tax return. Follow along as we break down the steps and explain each line of the form,.

Source: www.signnow.com

Source: www.signnow.com

Schedule a 20202023 Form Fill Out and Sign Printable PDF Template, Understanding how to report capital gains and losses on your tax forms is crucial for anyone dealing with investments or asset sales. The internal revenue service will soon release a comprehensive set of 1040 tax forms, schedules, and instructions for the tax year 2024.

Source: www.ferris.edu

Source: www.ferris.edu

Financial Aid Documentation, Complete form 1040, attach schedule 1, and add the amount to line 18 under adjustments to income. Welcome to our detailed tutorial on schedule 1 adjustments to income, an integral part of form 1040 for tax preparation.

Source: dl-uk.apowersoft.com

Source: dl-uk.apowersoft.com

Irs 1040 Printable Form, Form 1040 schedule 1 is the place to report types of income not included on form 1040, including taxable refunds of state and local income taxes, alimony received,. Schedule 1 has the following additional income and adjustments to income.

Source: www.signnow.com

Source: www.signnow.com

1040 Schedule 1 PDF 20202024 Form Fill Out and Sign Printable PDF, Whether you're a seasoned taxpayer o. Follow along as we break down the steps and explain each line of the form,.

Source: www.signnow.com

Source: www.signnow.com

Schedule E 1040 20202024 Form Fill Out and Sign Printable PDF, Whether you're a seasoned taxpayer o. Enter the amount you earned from tax credits, tax refunds or offsets for.

Source: www.signnow.com

Source: www.signnow.com

Schedule D 20202024 Form Fill Out and Sign Printable PDF Template, Schedule 1 is necessary if you have had any additional income or adjustments to your income. Enter the amount you earned from tax credits, tax refunds or offsets for.

Here's What You Should Do, Line By Line, To Complete Schedule 1 For 2024.

It’s used to report additional.

Schedule 1 Is Necessary If You Have Had Any Additional Income Or Adjustments To Your Income.

Form 1040 schedule 1 is the place to report types of income not included on form 1040, including taxable refunds of state and local income taxes, alimony received,.