Self Employment Quarterly Tax Form 2024. However, there are a variety of exceptions for different circumstances. If you don't have any or enough taxes withheld from your pay and expect to owe $1,000 or more, you usually need to pay quarterly estimated taxes.

There are four payment due dates in 2024 for estimated tax payments: January 16 (q4 payment of.

Self Employment Quarterly Tax Form 2024 Images References :

Source: www.employementform.com

Source: www.employementform.com

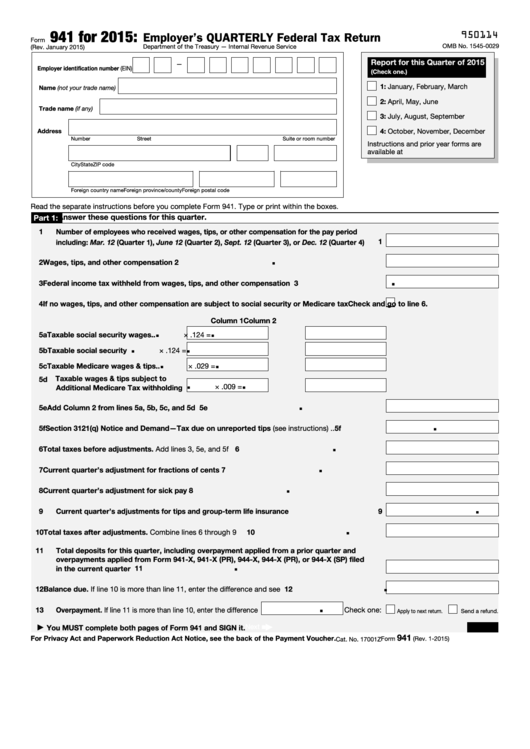

Quarterly Tax Form For Self Employed Employment Form, 1️⃣ take time to do your research and create a plan.

Source: kareeqvalina.pages.dev

Source: kareeqvalina.pages.dev

Employment Tax Forms 2024 Reiko Tersina, If you’re a sole proprietor, independent.

Source: aurelqrozele.pages.dev

Source: aurelqrozele.pages.dev

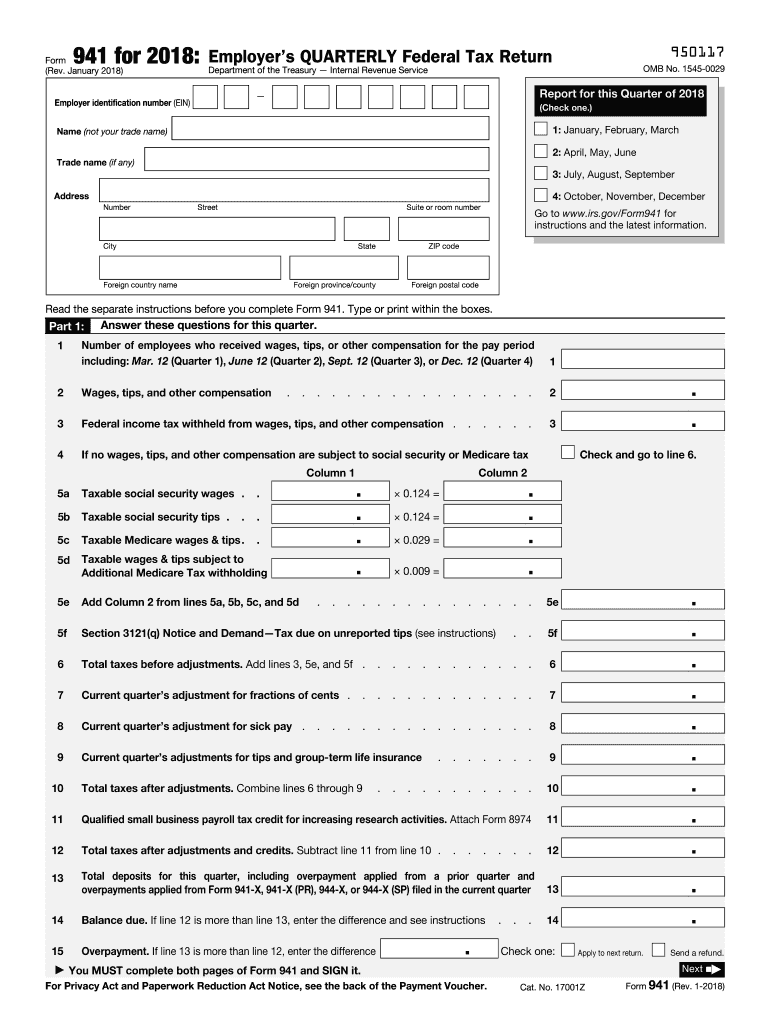

Quarterly Tax Payments 2024 Llc Jobey Lyndsie, Social security and medicare tax on unreported tip income.

Source: benedettawrenie.pages.dev

Source: benedettawrenie.pages.dev

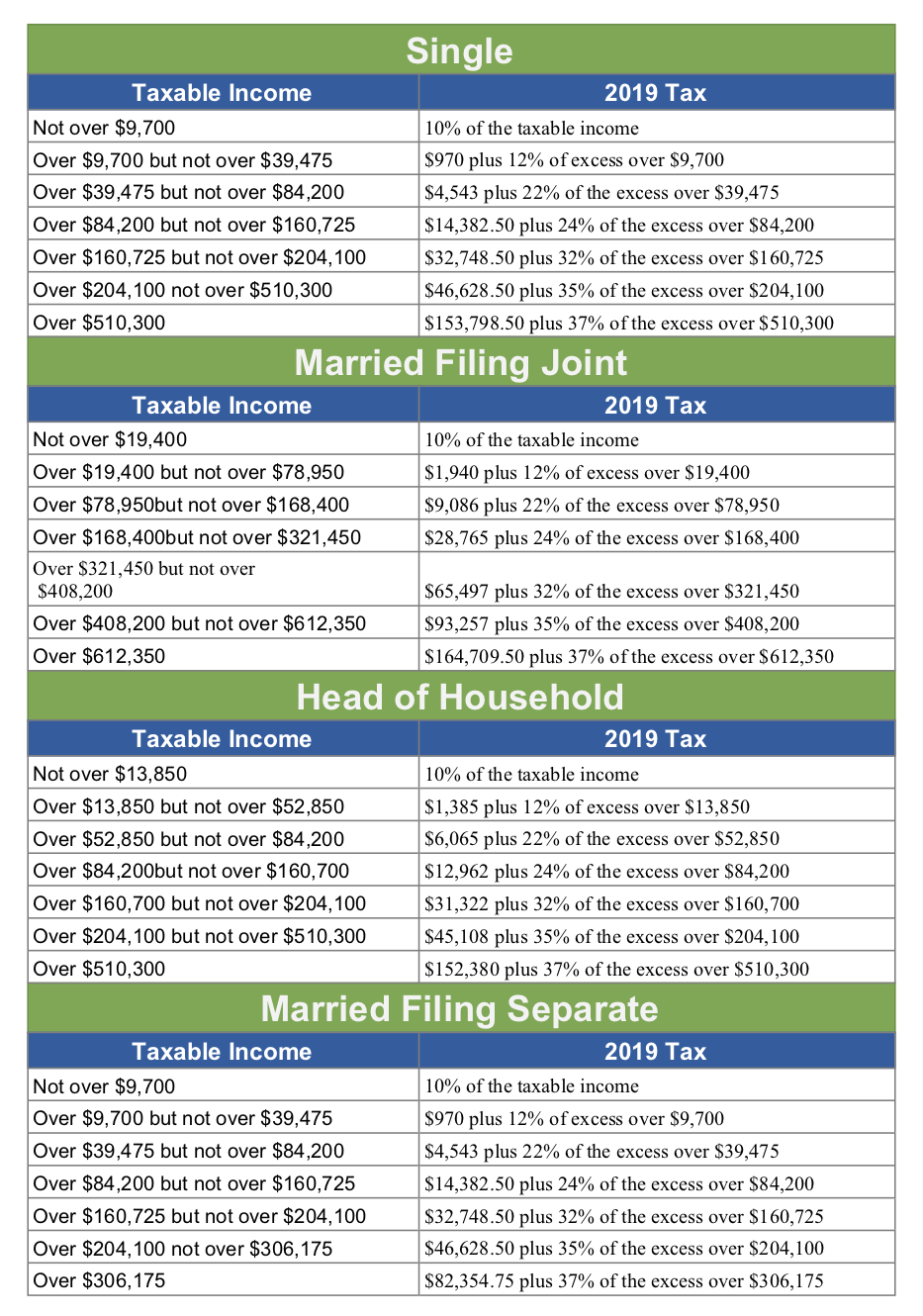

Tax Brackets For Self Employed 2024 Kalie Henriette, However, there are a variety of exceptions for different circumstances.

Source: wallethacks.com

Source: wallethacks.com

How Estimated Taxes Work, Safe Harbor Rule, and Due Dates (2024), Fill out a 036 form with the tax agency, where you’ll get an individualized tax id number.

Source: www.employementform.com

Source: www.employementform.com

Self Employment Quarterly Tax Form 2022 Employment Form, On turbotax online, i can only see filing option for 2023, but i have already filed for 2023.

Source: chrissiewjeana.pages.dev

Source: chrissiewjeana.pages.dev

Irs Tax Forms 2024 Nelia, 3️⃣ meeting tax and social security obligations as a self.

Source: adibnikolia.pages.dev

Source: adibnikolia.pages.dev

Estimated Tax Payments 2024 Self Employed Nert Sibylle, Fill out a 036 form with the tax agency, where you’ll get an individualized tax id number.

Source: www.employementform.com

Source: www.employementform.com

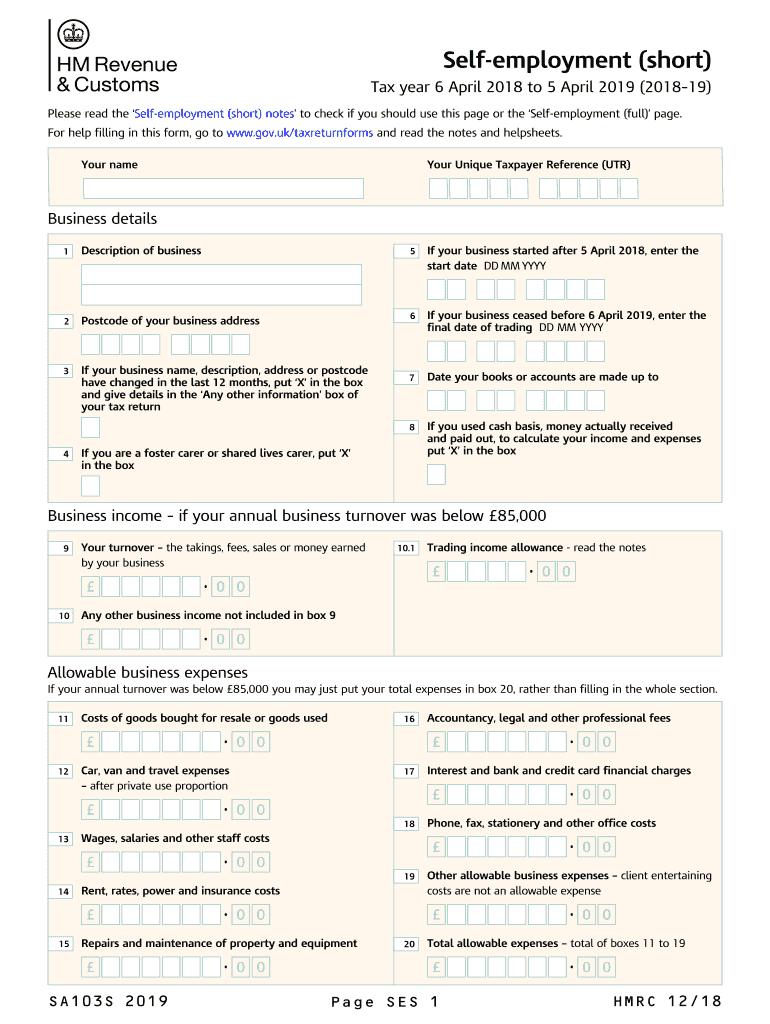

Self Employment Short Tax Return Form 2024 Employment Form, This percentage includes social security and medicare.

Source: www.employementform.com

Source: www.employementform.com

Self Employment Estimated Tax Form Employment Form, Not all freelancers and independent.

Posted in 2024